DVLA Current Forms and Documents

V317 Vehicle to vehicle registration transfer application form

This form, accompanied by the correct documents for each vehicle and a cheque for £80 payable to the DVLA, will allow your private registration to be transferred from one vehicle to another.

You will need to send your transfer to the DVLA here in Swansea.

The rules of the DVLA registration mark Transfer Scheme:

- Only MOT testable vehicles can take part in the scheme, e.g. no tractors, other agricultural vehicles or road repairing machines, such as steam rollers. Q-plated kit cars can’t take part either unless you have evidence of their age.

- You cannot transfer a private registration mark to a vehicle if it makes the vehicle appear younger than its date of first registration. For example, if a vehicle is first registered in October 1994, the latest issued registration mark it can bear is a prefix M registration.

- Some vehicles have registration marks that are “NON-TRANSFERABLE”. If this is the case, it will be printed in Section 3 (special notes) of the V5C and the mark must stay with that vehicle, it cannot be retained or transferred. A personalised number plate could however still be transferred TO a vehicle with a non-transferable mark on it.

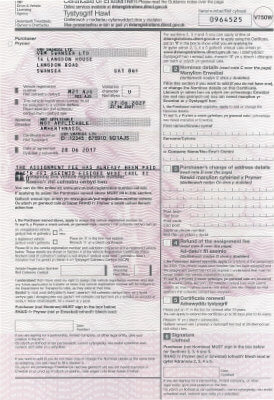

V750

V750 Certificate of Entitlement to a registration mark This pink-coloured government certificate is used to retain or hold the rights to a private registration mark, which has never been assigned, to a vehicle. New v750 certificates are valid for 10 years and they can be renewed for free.

Areas of the v750 certificate to note

- Name and Address of the Purchaser

- The Personalised Registration mark

- Certificate Expiry date

- Nominee name: The Nominee has no right to the registration number until it is assigned to their vehicle. Adding their name to this document means that the registration can be assigned to a vehicle registered to a keeper with the same name

- Add/Change Nominee: Only the Purchaser of the registration mark can apply to add or change the name of the Nominee

- Extension of entitlement period: Only the Purchaser of the registration mark can apply for a 10 year extension to the certificate

- Assignment fee: The £80 government assignment fee is shown as prepaid on the certificate

- The space to enter the current registration of the vehicle that the new registration is to be transferred to

- The ‘Validation Character’ - found next to the registration number on the vehicle’s logbook (V5C)

- The space to enter the expiry date of the vehicle’s road tax

- The Purchaser’s signature area to authorise changes or an assignment

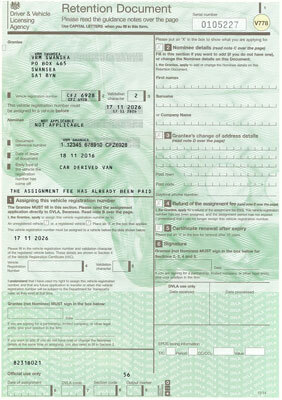

V778 Vehicle Registration mark Retention Certificate

The V778 retention certificate is a green-coloured government document for holding the rights to a private registration mark that has been previously displayed on a vehicle. The private registration will have been assigned to a vehicle at some point and has been ‘transferred’ off of that vehicle to be ‘stored’ for a period of 10 years on the certificate. The fee to retain a mark is £80 and this is for the future assignment to the next vehicle. The 10 year period can be extended for no additional fee.

You can retain your registration mark online: https://www.gov.uk/keep-registration-number

Areas to note

Name and address of the Grantee. This is the previous keeper of the vehicle that the registration mark was assigned to

The Personalised Registration mark

Certificate Expiry date

Nominee name: The Nominee has no right to the registration number until it is assigned to their vehicle. Adding their name to this document means that the registration can be assigned to a vehicle registered to a keeper with the same name.

Add/Change Nominee: Only the Grantee of the registration mark can apply to add or change the name of the Nominee

Extension of entitlement period: Only the Grantee of the registration mark can apply for a 10 year extension to the certificate

The space to enter the current registration of the vehicle that the new registration is to be transferred to

The ‘Validation Character’ - found next to the registration number on the vehicle’s logbook (V5C)

The space to enter the expiry date of the vehicle’s road tax

Assignment fee: The £80 government assignment fee is shown as prepaid on the certificate

The Grantee’s signature area to authorise changes or an assignment

INF 46 - Registration Numbers and You

This guidance booklet is produced by the DVLA to provide the public with a greater understanding of the UK’s personalised registration system.

Registering Your Vehicle Using a V55/4 or V55/5

V55/4 and V55/5 forms are used to register vehicles in the UK, ensuring that all Keeper information provided at the time of registration is genuine and correct, thus preventing the fraudulent registration of vehicles.

Documentation to confirm the registered Keeper’s name and address is required. Name and address checks are made on all applications.

A guide to completing the V55/4 along with a link to the form is available here: https://www.gov.uk/government/publications/apply-for-first-vehicle-tax-and-registration-of-a-new-motor-vehicle-v554

And a guide to completing the V55/5 along with a link to the form is available here: https://www.gov.uk/government/publications/register-a-used-vehicle-for-the-first-time-v555

MOT Test Certificate

The purpose of the MOT Test is to ensure that older cars, light vehicles, private buses and motorcycles are checked once a year to see that they comply with key legal requirements of road safety and roadworthiness. Vehicles registered in the mainland UK should receive their first MOT when they reach 3 years of age. Vehicles registered in Northern Ireland do not require an MOT until they reach 4 years of age.

Areas to note

- The registration mark

- The VIN (vehicle identification number) or chassis number

- The ‘valid from’ date

- The expiry date

- The MOT tester

- The MOT certificate will be issued by the MOT test centre.

Please see https://www.gov.uk/government/organisations/vehicle-and-operator-services-agency for more official information.

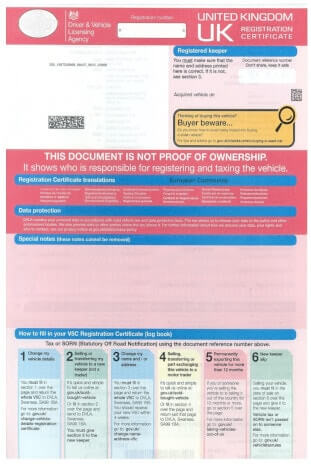

V5C Vehicle Registration Certificate (also known as the log book)

The purpose of a V5C UK Vehicle Registration Certificate is to register a Keeper to an identifiable vehicle. The registered Keeper of a vehicle does not have to be the person who owns the vehicle but the person nominated for the responsibility of that vehicle, i.e. the person liable for taxing it or the person who would be contacted by the police or other agencies regarding motoring or parking offences. There is both an English and Welsh Language log book version, supplied to Welsh residents.

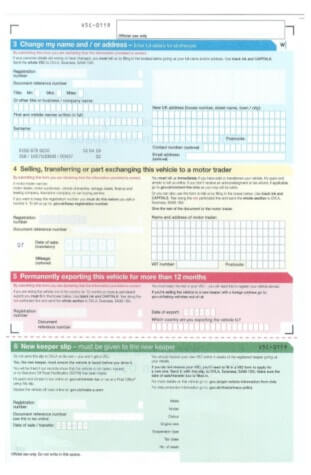

Old Style V5C (Issued until April 2019)

Areas to note:

- Registered keeper: This section details the name and address of the person/entity that is liable for the vehicle. The Keeper’s details need to match any Nominee’s details on government certificates (V750 or V778) when a personalised registration mark is assigned.

- Previous registered keeper.

- Special notes: This area contains important information. You will not be able to transfer the registration mark of or from the vehicle, if the following statement is printed in this area “non-transferable registration mark”. However you may still assign a personalised registration mark to the vehicle.

- Vehicle details: Includes the current Registration mark, the validation character (you will be asked for this when assigning a new registration mark to your vehicle) and the VIN (Vehicle Identification Number or ‘Chassis number’).

- The Registered keeper (not necessarily the owner)

- New keeper: complete this section to change any details about the Keeper, including changing any miss-spelling, change of address or change of name.

- Changes to current vehicle

- Declaration. This area must be signed by the registered Keeper (and the new Keeper if applicable) when notifying the DVLA of any changes.

- This area must be completed when the vehicle is transferred or sold to the motor trade, an insurance company or a dismantler.

Details for replacing a lost or damaged V5C can be found here: https://www.gov.uk/vehicle-log-book

New Style V5C/2 Registration Certificate

Front Cover

- The document reference number has moved to the top and the words ‘Don’t share, keep it safe’

- Multi-coloured guidance section has been added to the bottom

- Enforcement message has been added to the front

- The name and address on the front has moved to the top

- Date of acquisition has been moved to below the document reference number

Internal

- The vehicle details have been rearranged to the top half of the page to create extra room

- Change of keeper and change of name and address have been separated

- Customers can now supply contact details

- Section 5 (permanently exporting this vehicle for more than 12 months) – country of export field has been added

- Section 6 (new keeper’s slip) – name and address fields removed

Throughout

- Data capture boxes introduced for accuracy and simplification

- Signature boxes removed and replaced with declarations in red

- Welsh version on one side and English on the other

- Back page of the English document has been left blank

- V5CW – serialised across the three pages that are V5C issuing sections (at the top)

- V5C – serialised on the front cover and back page that are document issuing (at the top)

- Document reference number has been added to each section

- Simplified instructions

- Perforations have been changed on the last page (the only separated section is the green ‘new keeper’ slip)

This refers to part of the V5C known as the “New Keeper Supplement”. You should retain this section whenever any other section of the document is sent into the DVLA for alteration. In the event of changing the Registered Keeper of the vehicle, the new Keeper should be given this section as their proof of vehicle transfer until their new V5C arrives.

Please note: if you are submitting your documents to transfer a registration mark it is essential that this section is also sent in with the rest of the V5C.

V10 Application for Road Tax

This form is used when applying for road tax.

You will also need to present the following documents when applying for road tax:

- Your V5C (your Registration Certificate, or ‘Logbook’)

- A valid certificate of motor insurance

- Your MOT certificate

The fee necessary to purchase road tax, depends on the vehicle and the period for which it relates eg. 6 months, one year.

You can also tax your vehicle online: https://www.gov.uk/vehicle-tax

V149 Rates of Vehicle Excise Duty

This document details the price list for taxing UK vehicles for 6 month or 12 month periods.

V11 Road Tax Reminder

This is a reminder form, which is sent to the registered Keeper of a vehicle before the present road tax is due to expire. The form allows the Keeper to either purchase new tax or declare that the vehicle is off road (thus avoiding tax). The V11 can only be used at the post office and should not be mailed direct to DVLA.

V890 Statutory Off Road Notification (SORN) Application

V62 Application for a new V5C Registration Certificate

The V62 is an application form for a new V5C Registration Certificate (logbook). The V62 is used in cases where the original V5C has been lost, damaged or not received.

Unless you have never received a V5C, using a V62 form to obtain a new V5C will cost £25.00.

For more details, follow the link below:

https://www.gov.uk/vehicle-log-book

V765 Application to Register a Vehicle under its Original Number

This is a scheme with the intention of reuniting historical vehicles with their original registration marks. Many older vehicles were not recorded on the DVLA register when centralised registration was introduced in 1974. However, if you are the owner of such a vehicle and know what the original registration was, it may be possible to have it reassigned. You will need to send your application to the relevant authorised vehicle owners’ club, a list of which can be found by using the link below, with evidence of your claim:

you may find more information at the Vehicle registration knowledge base The club may charge a fee for this service but you should not have to join the club. If you do re-unite your vehicle with its former registration mark, this will not be transferrable to other vehicles. To apply for this scheme, a V765 and a V55/5 form need to be completed and a recent photograph of a pre-1983 tax discor MOT linking the vehicle to the original mark is required.

DVLA Historic Forms and Documents

V796 (NI)

Prior to 2014, vehicle tax and registration for vehicles in Northern Ireland was the responsibility of the DVLNI, or Driver & Vehicle Licensing Northern Ireland. The V796 (NI) was an information leaflet detailing the legal requirements relating to the display of number plates including character heights etc.

V317NI Northern Ireland Transfer Application Form

Prior to 2014, vehicle tax and registration for vehicles in Northern Ireland was the responsibility of the the DVLNI, or Driver & Vehicle Licensing Northern Ireland. The V317NI was very similar to the V317 form (above) and had the same application, with some differences:

As Northern Ireland format registration marks have no age identifier, they can be transferred freely between vehicles of any age.

Northern Irish vehicles only require an MOT certificate if there has been more than 4 years since first registration.

V948

This document is an authorisation certificate that proves entitlement to a specific registration mark, thus allowing the holder to purchase the appropriate number plates. The suppliers of the number plates will require you to provide this certificate and photo identification before the plates can be produced.

The DVLA no longer issue these certificates as standard. However, if you assign a registration online you can download and print an EV948

Tax Disc

Prior to 1st October 2014, if you wished to keep or use a vehicle on a public road, it was essential that you displayed a tax or licence disc to prove that you have either paid or were exempt from paying Vehicle Excise Duty (VED).You could pay every 6 months or once each year for a small discount on the price of 2 six month periods.

Since 1st October 2014, vehicle owners no longer need to display a tax disc on their vehicle. Taxing a vehicle now can be done at a post office, over the telephone, or online. The information is then automatically updated on the DVLA’s system which can be checked through the vehicle enquiry system provided by the DVLA.

Please see the information and Frequently Asked Questions detailed here: www.gov.uk/dvla/nomoretaxdisc